How the pandemic is re-shaping business aviation & comparing it to the current status of the airline industry.

While the global crisis has left many sectors of the world’s industry floundering, especially the aviation industry, we can confidently predict that business aviation is emerging stronger than before. In spite of the overall European business aviation activity in 2021 being behind that of 2019, the strong performance in the second half of last year proves an upward trend and provides us with an optimistic outlook. The impact of the pandemic and reduced airline activity has, to an extent, had an influence on business travelers habits, such as them getting accustomed to utilizing private jets. Meanwhile, business aviation is gaining market share, a change which is being driven by the pandemic.

The surge in summer activity

In Europe, the summer 2021 saw up to 90’000 business aviation flights both in July and August, 15% of this traffic had been completed by Mid-Size Jets (or roughly 13’000 flights, both in July and August). Light Jets held the majority of these flights with 38%. For the Mid-Size Jets, these two months saw a growth in traffic between 16% and 31% compared with July and August 2019. However, Light Jets and Turboprops were able to boast a larger growth with up to 35% and 30% respectively. The growth of Large Jets has been quite sluggish, as it has taken until August 2021 to record a higher activity level than 2019, since the breakout of the pandemic in March 2020.

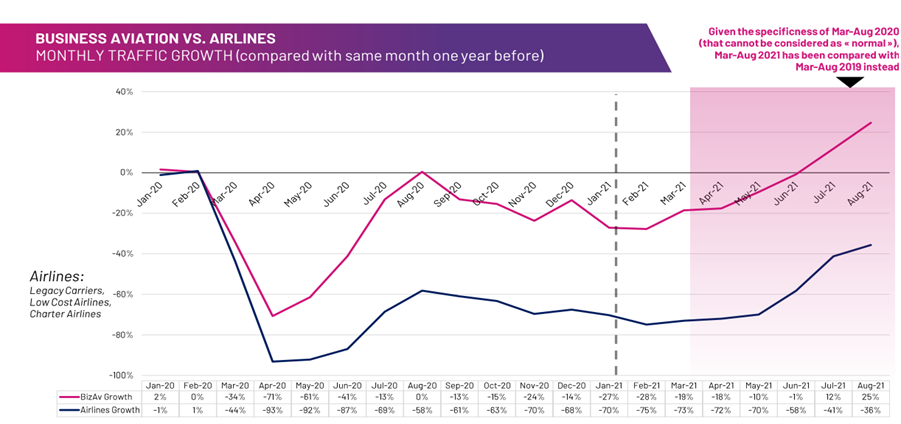

Comparing business aviation with airlines in Europe, business jet traffic had, by June 2021, already reached the activity levels of 2019 again, whereas the airline industry in that month was still struggling at a negative 58% to its 2019 activity. While the traffic growth has been steady in both sectors since then, airlines had still only recovered to a weak negative 36% by the peak of summer, while business jet traffic managed to soar to a remarkable 25% growth over August 2019. Overall, the August European IFR traffic reached 71% of the 2019 level.

Paris most popular destination in Europe

Paris Le Bourget and Nice Côte D’Azur were the most popular business aviation destinations in August and the route connecting these two airports in the summer was the busiest with a 73% increase in movements compared to August 2019. Looking at 2021 as a whole, this route was only second busiest, however. In spite of suffering a 16% loss in traffic, Paris-Geneva still managed to top the list.

Intercontinental business aviation connections between Europe and Central America/Caribbean posted a whole 48% increase from January to August compared with the same time frame in 2019.

Significant increase in commercial flights

From March 2021 onwards, both commercial and non-commercial business aviation traffic experienced a strong push, with the charter segment showing an increase in flights of up to 37% in August, compared with the same month in 2019. In fact, the growth in the non-commercial sector even paralleled the growth in the commercial sector, but since non-commercial operations had been more affected by the pandemic, its growth in traffic only enabled a 13% increase by August 2021, compared with summer of 2019.

The percentage of commercial business aviation flights in 2021 was at 62%, gaining another 6% market share over non-commercial business aviation.

The predicted increase in wealth-rate among the High Net Worth Individuals in Europe is also a contributing factor for maintaining a strong charter demand. Yet, the biggest growth in traffic and charter demand is predicted to take pace in Asia.

A detailed look at Mid-Size Jets for charter

As demand for charter service has increased, Swiss Aviation Consulting decided to analyze the Mid-Size and Super Mid-Size business jets in Europe, specifically the European Union, United Kingdom, Switzerland and Norway, which are currently available for charter.

As the following results show, customers and business travelers have a large amount of choice, and this analysis only regards Mid-Size Jets. If you consider the Small Jets and Turboprops as well, the charter possibilities for domestic European business travel can be even more increased. Additionally, these times seem to be favorable for new start-ups as well as for existing air operators to expand their fleets. This results in continuingly more aircraft being provided to the charter market.

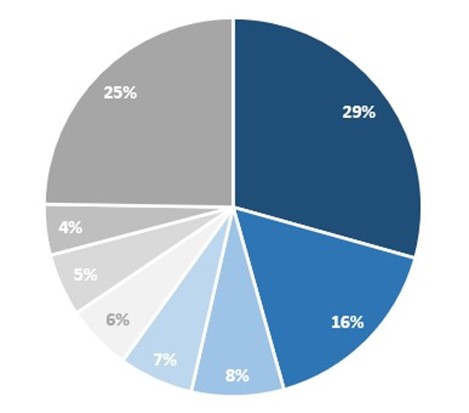

Split of Mid-Size/Super Mid-Size Charter Capacity by Aircraft Type

There are currently about 392 Mid-Size and Super Mid-Size business jets available for charter. This is approximately 14% of all registered business jets in the aforementioned region.

Nearly one third of the 392 jets are of the Cessna Citation 560 models. The Bombardier Challenger 300/350 is the second most common jet, however, the fleet size only being about half of that of the Citation 560. The Citation Latitude, being the third most available jet, again is half as common as the second-placed Challenger 300/350.

392 Aircraft in total

- Excel 560XL/XLS 560/XLS+560 [29%; 115]

- Challenger 300/350 [16%, 64]

- Citation Latitude 680A [8%; 31]

- Learjet 60 [7%; 25]

- Legacy 500/Praetor 600 [6%; 22]

- Learjet 45 [5%; 21]

- Citation Sovereign/+ 680 [4%; 17]

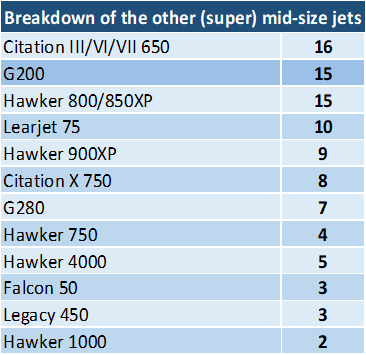

- other (super) mid-size jets [25%; 97]

Source: Amstat, JetNet, Official websites of operators

Date of analysis: 02.12.2021

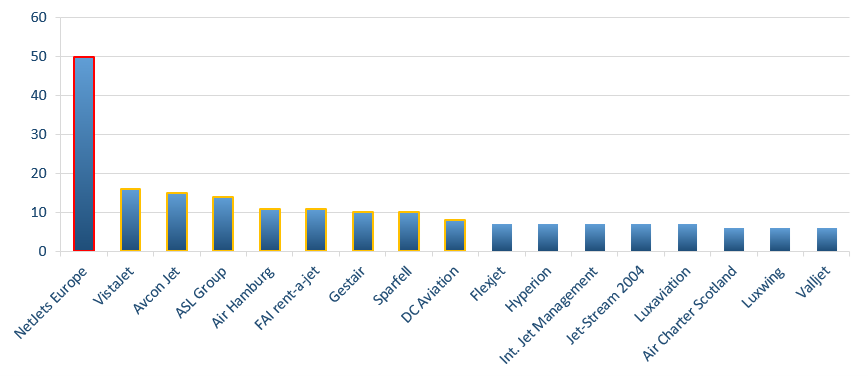

Number of (Super) Mid-Size Business Jets per Operator for Charter

NetJets Europe holds a 13% market share in the Mid- and Super Mid-Size segment, with 50 of their aircraft being jets of the types Citation XLS, Latitude and Challenger 350 (the three most widely used Mid-Size models in Europe).

Further major established competitors have between 8 and 16 aircraft in this segment.

There are a total of 125 operators in the region providing charter service with Mid- and Super Mid-size business jets.

Source: Amstat, JetNet, Official websites of operators

Date of analysis: 02.12.2021

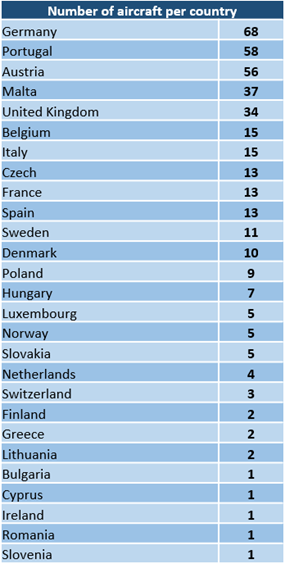

Number of (Super) Mid-Size Business Jets per European Country

Almost half of all available Mid- and Super Mid-Size jets are based in Germany, Austria and Portugal.

The 68 available jets in Germany are divided among 21 operators.

In Portugal, 86% of the available jets are provided by one operator (NetJets Europe).

In Austria, the ratio of available jets to operators is approximately the same as in Germany.

Operators, which have their headquarters in a certain country, may have some of their aircraft based in other countries. The following chart and list have taken this into consideration as far as possible and present the actual number of aircraft per country.

Source: Amstat, JetNet, Official websites of operators

Date of analysis: 02.12.2021

Business jet sales during the pandemic

2021 has been a remarkable year for new and used business aircraft sales. Only 5,6% of all active Mid-Size and Super Mid-Size Jets worldwide are now for sale. This is 55,8% less availability than a year ago. The very desired Challenger 300 models, for e.g., had an average time of 91 days on the used market up until June 2021. The high number of transactions expresses the strong demand for these jets, with availability becoming more and more limited. For new aircraft, delivery times have even been extended to 24 months. Consequently, many future buyers will see themselves required to use chartered jets, which will maintain the strong demand for charter service for some time to come. This could lead to more owners placing their aircraft on the operating certificate of an aircraft management company, as they hope to take advantage of this trend in order to generate some charter revenue when their business jet is not needed.

The Large Jet segment is a promising segment at the moment due to international borders opening up again and the returned possibility for long-range travel. Pre-owned Large Jet transactions are therefore forecast to increase by 10% in 2022 over 2021, Mid-Size to increase by 7%.

The outlook for the aviation industry

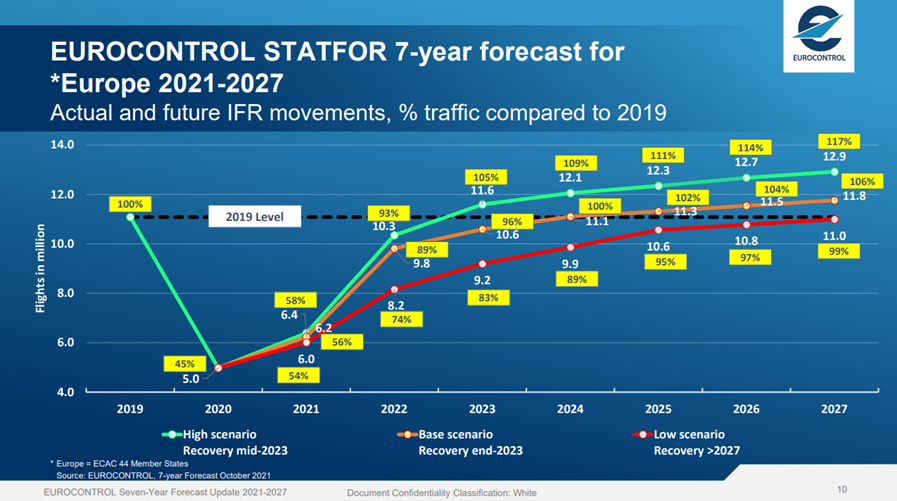

Airline traffic may have lost nearly two years of growth due to COVID, but it’s demonstrated resilience will enable the pre-pandemic annual growth rate of 3.9% to be resumed, once the values of 2019 have been regained again.

The structure of airline fleets are, however, foreseen to shift more towards 60-150 seat aircraft, as these (large regional) jets have proven in the pandemic to be more efficient on medium-range routes. Their versatility enables proper rightsizing and this size category is more flexible for the airline to withstand future downturns.

The availability of point-to-point connections will see a rise with newly established regional hubs, possibly competing with business aviation on secondary routes.

Of three possible recovery scenarios published by Eurocontrol (High, Baseline and Low), the current epidemiologic situation in January of 2022 places us in between their Baseline and Low Scenario, which predicts all European IFR air traffic to recover to the 2019 level by Q3 of 2025.

If it turns out that new emerging variants of the virus dissipate sooner than anticipated, the recovery in traffic will occur quicker, presumably already by Q3 2023. One has to consider, however, that the number of passengers usually lags behind the increase in number of flights.

Sources:

EBAA, Traffic Tracker Europe [August 2021]

Eurocontrol, Forecast Update 2021-2017 [15 October 2021]

Airbus, Global Market Forecast 2021-2040

Embraer, Market Outlook 2021

Elliotjets, Challenger Summer 2021 Market Report

Avbuyer, Volume 26 Issue 1 2022

Amstat

Jetnet

Official websites of air operators